2024 FDA Approved Drug Roundup

2024 FDA Approved Drugs

In our last post, we shared the news of FDA-approved drugs for the treatment of schizophrenia. This time, we'll look at the drugs approved in 2024.

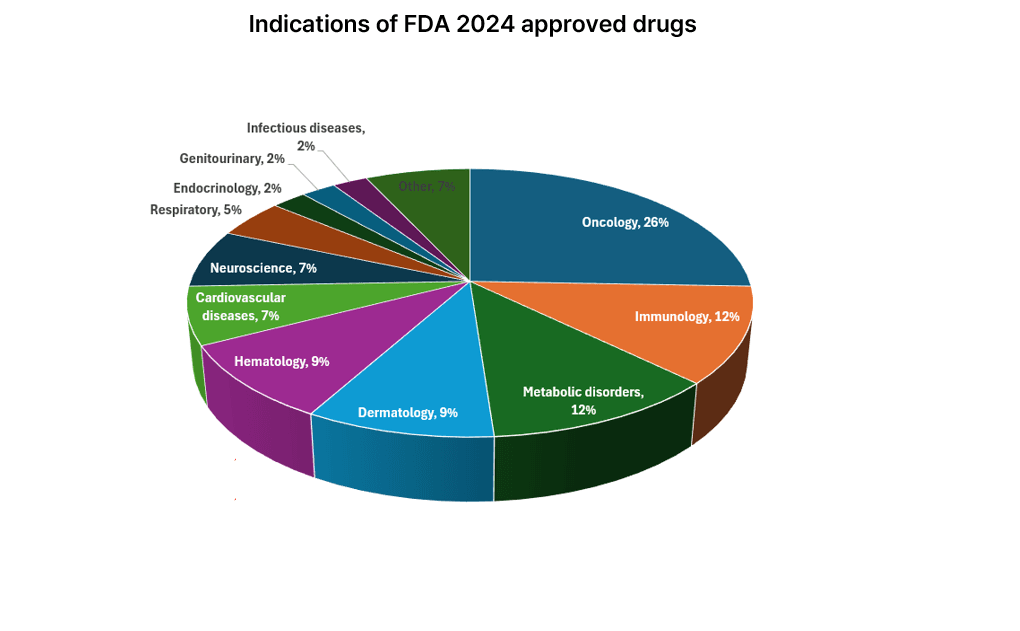

2024 FDA Approved Drugs: Classification by Indication

In 2024, 50 drugs were approved. First, we classified the approved drugs by indication, and oncology accounted for the highest proportion this year. In particular, oncology brought good news to the Korean pharmaceutical and bio-industry with the approval of Lazertinib, developed by Yuhan Yanghwa. In addition, immunology and metabolic disorders also accounted for a significant proportion.

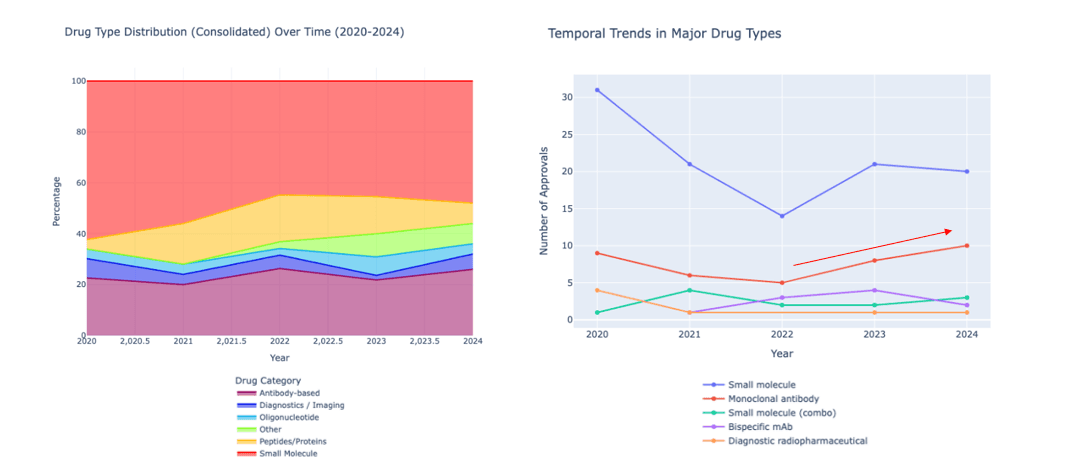

2024 FDA-approved drugs: Drug type classification

As drugs for different indications have been developed, so have drug types. Small molecules still dominate, accounting for 16 out of 50 drugs (32%), but antibody-based drugs have also gained ground, with 10 drugs accounting for 20%. According to one post, market share crossover between small molecules and mAbs may not occur until the mid to late 2030s. Monoclonal antibodies may still lag behind small molecules in overall approvals, but they are showing strong annual growth rates. Oncology and immunology remain important therapeutic areas, while mAbs are expanding into new areas such as neurology and rare diseases. Bispecific monoclonal antibodies are a particularly promising form, with zenocutuzumab and zanidatamab receiving approval in 2024. Additionally, this year saw the development of an antisense oligonucleotide, Olezarsen, for the treatment of familial chylomicronemia syndrome.

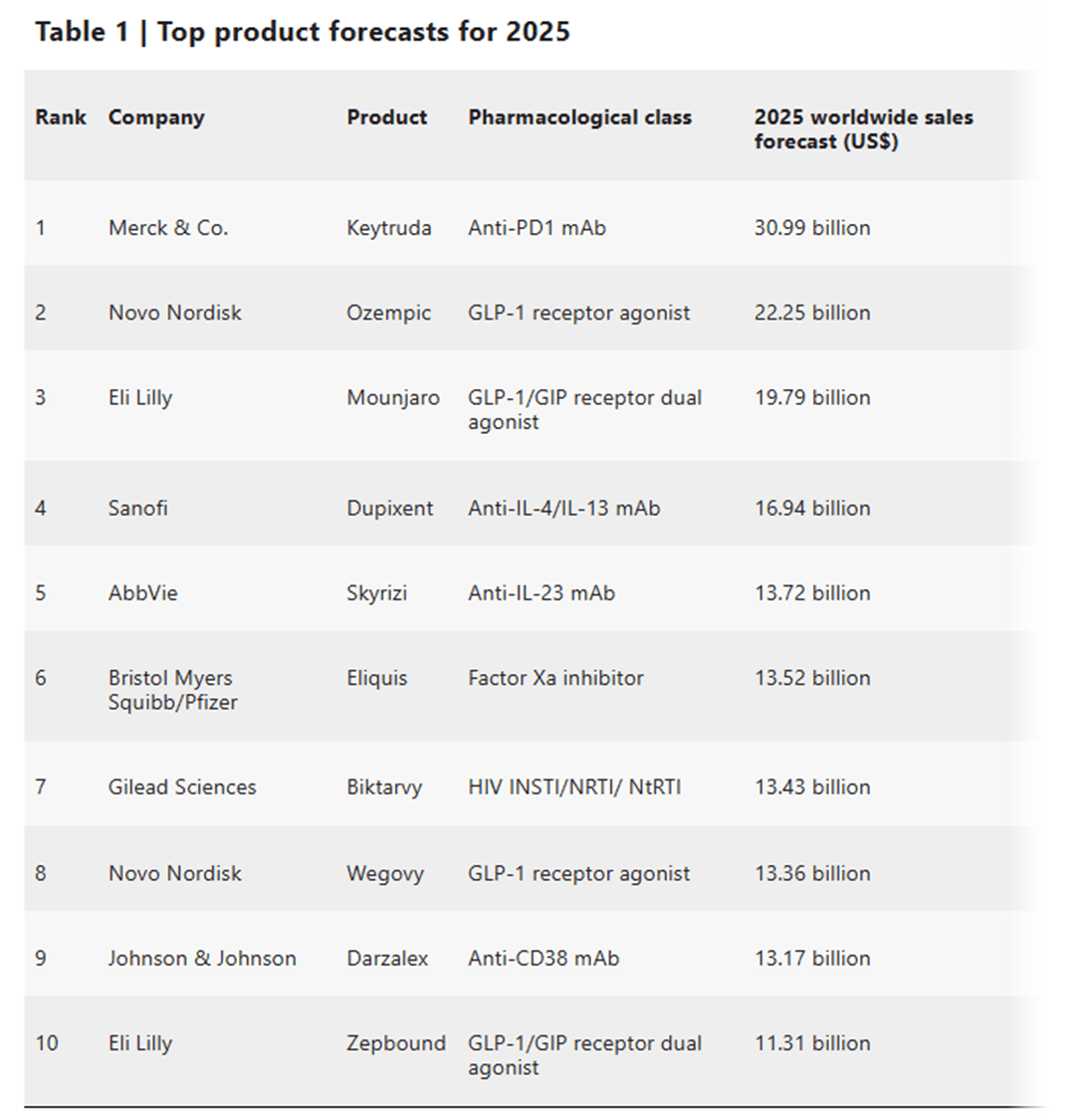

2024 FDA approved drugs: Top 10 drugs with projected sales in 2025

This time, we'll look at it from a revenue perspective. Metabolic diseases, especially diabetes, and obesity, are expected to be a major topic of discussion in the pharmaceutical industry in 2025, and compared to 2024, there is a significant shift in the top 10 drugs in 2025, with new metabolic disease treatments entering the top 10.

1. Highest-grossing drug: Merck's Keytruda

Merck's anti-PD1 monoclonal antibody Keytruda is expected to remain the top-selling drug in 2025. Sales of approximately $31 billion are forecast, driven by its use in a wide range of cancer indications and active clinical development. In 2024, the drug continued its indication expansion with positive clinical data in cervical cancer, triple-negative breast cancer, and head and neck cancer. However, sales are expected to remain volatile due to patent expiry, biosimilar competition, and the introduction of new subcutaneous formulations.

2. The rise of metabolic disease therapeutics

Metabolic disease therapeutics will account for 40 percent of the top 10 products in 2025. Leading products include:

-

Novo Nordisk: Ozempic

This diabetes treatment is expected to generate $22bn in sales, up 22% year-on-year.

-

Eli Lilly: Mounjaro

A GLP-1 and GIP dual agonist, it is expected to be the biggest growth driver among diabetes drugs, with sales of $20 billion, up 50 percent year-on-year.

-

Novo Nordisk: Wegovy

An obesity treatment is expected to generate $13 billion in sales in 2025, up 59 percent year-on-year.

-

Eli Lilly: Zepbound

Revenue of $11 billion is expected for the obesity treatment, up more than 100 percent year-on-year.

3. Steady growth in the field of immunology

There are also products in the immunology space that are seeing notable growth:

- Dupixent Sanofi and Regeneron's anti-IL-4/IL-13 antibody, Dupilumab, is expected to increase sales to $17 billion with the approval of an additional indication for chronic obstructive pulmonary disease (COPD).

- Meanwhile, Lebrikizumab (Ebglyss), approved in 2024, is emerging as a competitor to Dupilumab in the treatment of atopic dermatitis. The two drugs differ in their mechanisms: Dupilumab is a dual-acting antibody that blocks both IL-4 and IL-13 signaling, while Lebrikizumab, developed by Eli Lilly, is a single-acting antibody that selectively blocks only IL-13. Ebglyss may also be differentiated by its administration schedule, as it is given as a 250mg subcutaneous injection every four weeks, allowing for a longer interval between maintenance doses. Looking ahead, Ebglyss is expected to generate $2.8 billion in sales by 2030, whereas Dupilumab is forecasted to reach $23.6 billion due to its expanding indications for various inflammatory diseases such as asthma and COPD.

- Skyrizi AbbVie's Skyrizi (anti-IL-23 antibody) is expected to generate $13.7 billion in sales, driven by its increasing applications in inflammatory bowel disease and dermatological conditions.

2024 FDA Approved Drugs: Notable Drugs in the Second Half of 2024 - Inavolisib, New Hope for Breast Cancer Treatment

Inavolisib (GDC-0077) is a PI3Kα inhibitor that targets the PIK3CA mutation commonly found in cancer cells and is attracting attention for its distinct mechanism of action from existing therapies.

Inavolisib's Differentiated Mechanism of Action

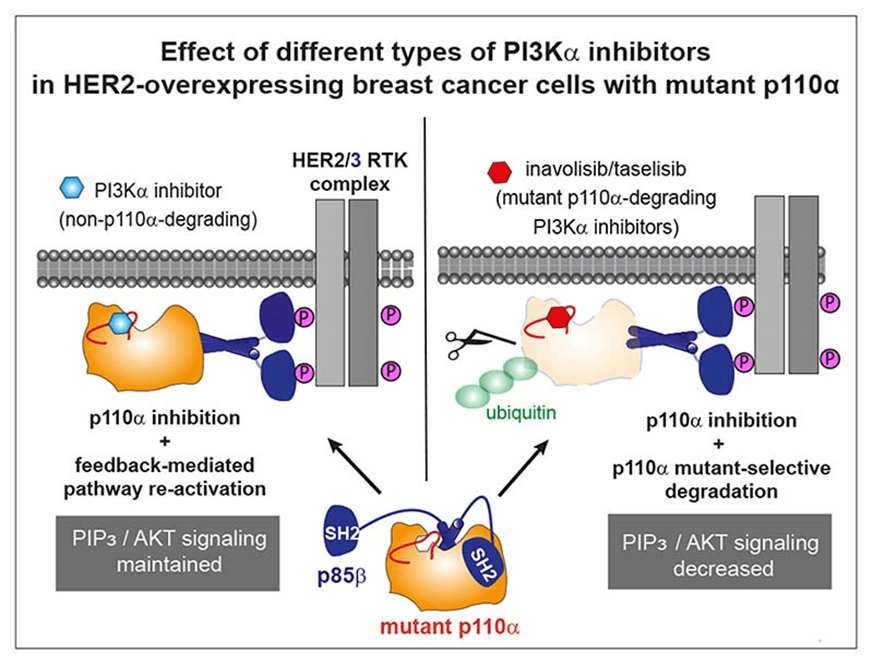

Unlike existing PI3Kα inhibitors, Inavolisib has a unique mechanism of action that selectively degrades the mutated p110α protein rather than simply inhibiting it. Inavolisib has the following distinguishing features.

- p110α inhibition: blocks the conversion of PIP2 to PIP3, thereby inhibiting AKT signalling.

- Selective degradation of mutated p110α: targets and degrades the mutated p110α protein, more thoroughly blocking this signalling pathway in cancer cells.

- Preserves normal cells: wild-type p110α is preserved, so it has little effect on normal cells, reducing the risk of side effects.

HER2 Dependence and the Therapeutic Effect of Inavolisib

Inavolisib has a mechanism of action that is dependent on receptors associated with HER2. HER2 is a key signaling receptor that activates PI3K-α. When activated, HER2 triggers a signaling cascade involving PI3K-α, PIP3, and AKT in sequence, ultimately promoting cancer cell survival and growth. By selectively ubiquitinating and degrading PI3K-α, which has been modified through HER2 signaling, Inavolisib can effectively target HER2-positive cancers. This indicates that HER2 plays an important role in the effective action of Inavolisib, contributing to its efficacy in HER2-positive cancers.

Clinical Data and Outlook

In several clinical trials, Inavolisib has demonstrated excellent efficacy in HR-positive, and HER2-negative metastatic breast cancer patients with PIK3CA mutations. Notably, the INAVO120 trial showed that combination therapy with the CDK4/6 inhibitor palbociclib and fulvestrant extended progression-free survival (PFS) to 15 months. The duration of response was nearly twice as long in the treatment arm, at 18.4 months, compared to the control arm, with an objective response rate (ORR) of 58%. These results highlight the potential role of Inavolisib in the treatment of breast cancer with PIK3CA mutations.

What 2024 FDA-approved drugs will give us in the future

The FDA-approved drugs of 2024 are providing patients with better treatment options through innovative mechanisms and therapeutic effects that push the boundaries of conventional medicine. Notable achievements in oncology, metabolic diseases, and immunology, among others, are driving a paradigm shift in healthcare. In addition, advances in various drug types (small molecules, mAbs, etc.) demonstrate the potential for continued growth in the pharmaceutical industry.

Research and investment in drug discovery will continue to accelerate in 2025 and beyond, and these efforts will play an important role in addressing global health challenges. Hyperlab will continue to support researchers in their drug discovery journey with innovative platforms and open up new possibilities.

Start your free trial: https://abit.ly/kgf6ny

Schedule a meeting: https://abit.ly/6tr1uz